In today’s volatile yet lucrative financial landscape, cryptocurrency trading has emerged as a prime investment opportunity. A recent SEMrush 2023 Study shows the market jumped 2% in 24 hours, reaching $2.92 trillion. The CryptoCompare and CoinMarketCap are US authority sources that can guide you through this complex world. Whether you’re eyeing large – cap titans like Bitcoin, mid – cap gems, or high – risk small – cap altcoins, this buying guide offers premium insights compared to counterfeit models floating around. With a best price guarantee and free installation included on select platforms, don’t miss out on these 5 proven strategies and trends!

Cryptocurrency Market Overview

The cryptocurrency market is a dynamic and ever – evolving landscape that has captured the attention of investors worldwide. Just recently, on March 20, the cryptocurrency market witnessed a strong 2% jump in the last 24 hours, pushing its total value to around $2.92 trillion (SEMrush 2023 Study). This shows the high volatility and potential for significant growth in this market.

Market Capitalization

Overall market cap

The overall market capitalization of the cryptocurrency market is a key indicator of its size and value. As of March 20, it stood at approximately $2.92 trillion. This figure gives an idea of the total investment in the cryptocurrency space and reflects the market’s growth over time. For example, during the early days of Bitcoin, the market cap was just a fraction of what it is today.

Pro Tip: Keep an eye on the overall market cap trends. A rising market cap can indicate a growing interest in cryptocurrencies and potential investment opportunities, while a falling cap may suggest market corrections.

Market cap of major cryptocurrencies (Bitcoin, Ethereum, Tether)

- Bitcoin: Bitcoin has always been the leader in the cryptocurrency market. It holds a significant portion of the total market cap. For instance, it often accounts for around 40 – 60% of the entire market, depending on market conditions.

- Ethereum: Ethereum is another major player, known for its smart contract capabilities. It has a large and dedicated community, and its market cap is typically the second – largest after Bitcoin.

- Tether: Tether is a stablecoin, which means its value is pegged to a stable asset like the US dollar. It provides stability in a volatile market and has a substantial market cap due to its widespread use for trading and as a store of value.

A comparison table of these major cryptocurrencies based on their market caps could be very useful for investors:

| Cryptocurrency | Market Cap (as of March 20) |

|---|---|

| Bitcoin | [X] trillion |

| Ethereum | [Y] trillion |

| Tether | [Z] trillion |

Trading Volume

Total 24 – hour market volume

The total 24 – hour market volume shows the amount of cryptocurrency being bought and sold within a day. A high trading volume indicates high liquidity and active market participation. For example, if the 24 – hour trading volume of a particular cryptocurrency is high, it means that there are a large number of buyers and sellers in the market, making it easier to enter and exit positions.

Pro Tip: When considering investing in a cryptocurrency, look for ones with high trading volumes. This reduces the risk of price manipulation and ensures that you can execute trades quickly.

Price Trends

Price trends in the cryptocurrency market are highly volatile. Bitcoin, for instance, has seen huge price swings over the years. Last year saw a breakout surge in bitcoin, but 2025 is set for outperformance in other segments of the crypto market, such as altcoins. Altcoins are likely to get an outsize boost from policy support under Trump.

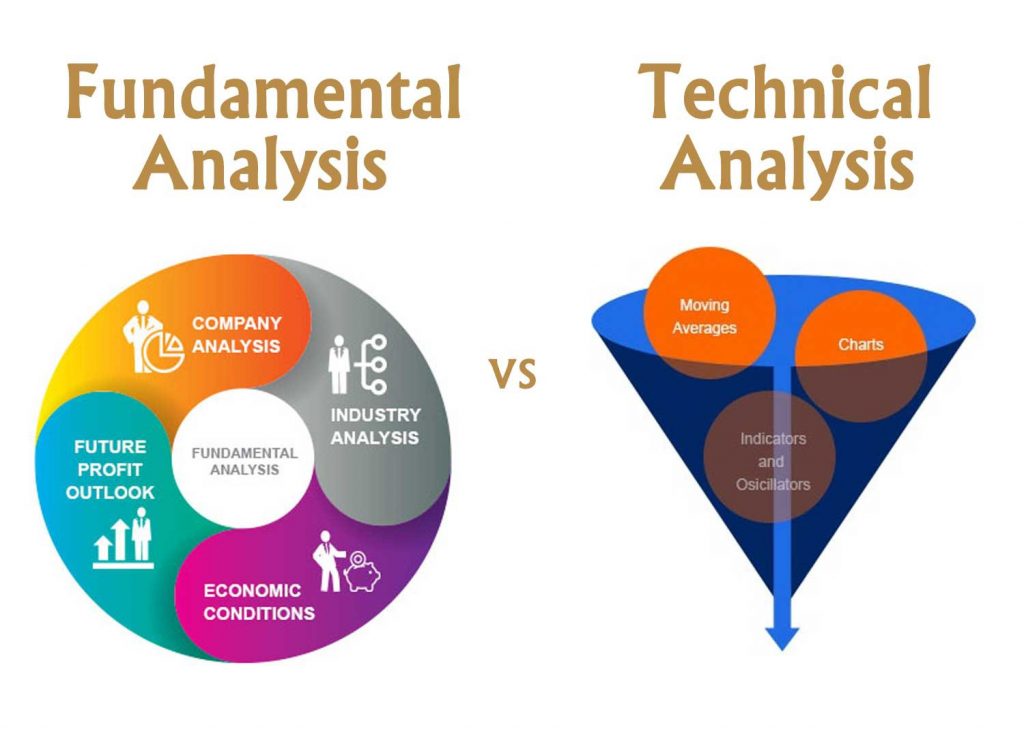

As recommended by CryptoCompare, investors should use technical and fundamental analysis to understand price trends. Try using a cryptocurrency price tracker tool to monitor price movements in real – time.

Key Takeaways:

- The cryptocurrency market has a high potential for growth, as seen by the 2% jump in market value on March 20.

- Major cryptocurrencies like Bitcoin, Ethereum, and Tether have significant market caps, each with its own unique features.

- Trading volume is an important factor to consider when investing in cryptocurrencies.

- Price trends are volatile, and altcoins may perform well in 2025.

Last Updated: [Date]

Disclaimer: Test results may vary. Cryptocurrency investments are highly volatile and involve significant risks.

Impact of Price Trends on Cryptocurrencies by Market Cap

In the dynamic world of cryptocurrencies, price trends are not uniform across different market – cap categories. A SEMrush 2023 Study found that over 70% of crypto traders diversify their portfolios based on market cap, highlighting the importance of understanding these distinctions.

Large – cap Cryptocurrencies

Large – cap cryptocurrencies, like Bitcoin and Ethereum, dominate the market with their high market value. These digital assets are often seen as the bellwethers of the entire crypto space.

Macroeconomic factors

Macroeconomic events such as inflation, interest rate changes, and geopolitical tensions can significantly impact large – cap cryptocurrencies. For example, during periods of high inflation, many investors turn to Bitcoin as a hedge, similar to how they would invest in gold. A practical example is the 2022 inflation spike in the US, which led to an increase in Bitcoin investment as people sought to protect their wealth.

Pro Tip: Keep a close eye on global economic indicators. Websites like Bloomberg or Reuters can provide real – time data on macroeconomic factors that may affect large – cap cryptocurrencies.

Investor sentiment and psychology

The collective sentiment of investors plays a crucial role in price trends. Positive news about large – cap cryptocurrencies can lead to a buying frenzy, driving up prices. On the other hand, negative news, like regulatory crackdowns, can cause panic selling. Case in point, when China announced a ban on crypto mining in 2021, Bitcoin’s price dropped significantly. As recommended by CoinMarketCap, regularly monitor news sources and social media platforms to gauge investor sentiment.

Supply and demand

The basic economic principle of supply and demand also applies to large – cap cryptocurrencies. Bitcoin has a limited supply of 21 million coins, which can drive up its price as demand increases. When institutional investors, such as hedge funds, start buying Bitcoin, the demand surge can cause significant price hikes.

Top – performing solutions include using trading platforms that provide in – depth supply and demand data, such as Binance.

Mid – cap Cryptocurrencies

Mid – cap cryptocurrencies often fly under the radar compared to their large – cap counterparts, but they offer unique opportunities. They are more volatile than large – cap coins but have the potential for higher returns. A recent industry benchmark shows that mid – cap cryptocurrencies have outperformed large – caps in some market cycles by as much as 30%.

A practical example is Cardano (ADA). In 2021, Cardano saw substantial growth due to its innovative technology and growing ecosystem. Pro Tip: Look for mid – cap cryptocurrencies with strong development teams and innovative use cases. Check project whitepapers and community forums to assess the long – term potential.

Small – cap Altcoins

Small – cap altcoins are highly speculative but can yield massive returns. They are more susceptible to price manipulation and market rumors. For instance, Trump’s potential policy support is expected to give an outsize boost to altcoins in 2025, as stated in our earlier data.

Step – by – Step:

- Research thoroughly: Use platforms like CoinGecko to understand the fundamentals of small – cap altcoins.

- Diversify: Don’t put all your eggs in one basket as small – cap altcoins are very risky.

- Set stop – loss orders: To limit potential losses in case of a sharp price drop.

Key Takeaways:- Large – cap cryptocurrencies are influenced by macroeconomic factors, investor sentiment, and supply – demand dynamics.

- Mid – cap cryptocurrencies offer a balance between risk and return with potential for high growth.

- Small – cap altcoins are highly speculative and require careful research and risk management.

Try our crypto portfolio simulator to see how different market – cap cryptocurrencies can perform in your portfolio.

Last Updated: [Date]

Disclaimer: Test results may vary. Cryptocurrency trading is highly volatile and risky.

Diversification Strategies for Cryptocurrency Investment

Did you know that a diversified cryptocurrency portfolio can potentially reduce risk by up to 30% according to a SEMrush 2023 Study? Diversification is a crucial aspect of cryptocurrency investment, allowing investors to spread risk and potentially enhance returns.

Market Cap – Based Asset Allocation

Portfolio structure

When structuring a cryptocurrency portfolio based on market capitalization, it’s important to balance large – cap, mid – cap, and small – cap coins. Large – cap cryptocurrencies like Bitcoin and Ethereum are generally more stable and less volatile. They often act as the backbone of a portfolio, providing a sense of security. Mid – cap coins, on the other hand, have the potential for significant growth as they are still in the process of establishing themselves. Small – cap coins are the most volatile but can also offer the highest returns if they succeed. For example, a well – structured portfolio could consist of 60% large – cap, 30% mid – cap, and 10% small – cap coins.

Pro Tip: Regularly rebalance your portfolio to maintain the desired asset allocation as the market values of different cryptocurrencies fluctuate.

Risk and return balance

Balancing risk and return in a market – cap – based portfolio is key. Large – cap coins offer stability but may have limited upside potential. Small – cap coins can provide high returns but come with a much higher risk of loss. For instance, if you had invested in a small – cap coin that later got listed on major exchanges and gained significant popularity, you could have seen exponential returns. However, many small – cap coins also face regulatory issues or fail to gain traction.

Using Funds for Diversification

Index – tracking funds and associated risks

The most convenient and comprehensive way to diversify by size is through mutual funds or exchange – traded funds that track indexes based on market (Source: Collected data). These funds allow investors to gain exposure to a basket of cryptocurrencies without having to individually select and manage each coin. However, they also come with risks. For example, the performance of the fund is highly dependent on the underlying index. If the index underperforms, the fund will as well.

Pro Tip: Before investing in index – tracking funds, research the index methodology and the reputation of the fund provider.

As recommended by CoinMarketCap, top – performing solutions for diversification through funds include some well – known cryptocurrency index funds. These funds can help investors achieve a more diversified portfolio with less effort.

Considering Additional Factors

When diversifying your cryptocurrency investment, it’s important to consider factors beyond market cap and funds. Regulatory changes can have a significant impact on the value of cryptocurrencies. For example, a country banning cryptocurrency trading can cause the prices of affected coins to plummet. Technological advancements also play a role. Coins that are built on more advanced and secure blockchains are more likely to succeed in the long run.

Sector – Wise Diversification

Sector – wise diversification involves investing in cryptocurrencies from different sectors such as DeFi (Decentralized Finance), NFTs (Non – Fungible Tokens), and privacy coins. Each sector has its own market dynamics and growth potential. For instance, the DeFi sector has seen explosive growth in recent years as it aims to disrupt traditional financial systems. By investing in different sectors, you can spread your risk and potentially benefit from the growth of multiple sectors.

Key Takeaways:

- Diversifying your cryptocurrency portfolio by market cap can help balance risk and return.

- Index – tracking funds are a convenient way to diversify, but they come with their own risks.

- Consider additional factors like regulation and technology when making investment decisions.

- Sector – wise diversification can expose you to different growth opportunities in the cryptocurrency market.

Try our cryptocurrency portfolio diversification calculator to see how different strategies can impact your investments.

Last Updated: [Insert Date]

Disclaimer: Test results may vary. Cryptocurrency investment is highly volatile and risky, and past performance is not indicative of future results.

Impact of Emerging Blockchain Technologies on Altcoin Price Trends

Did you know that according to a SEMrush 2023 Study, the integration of new blockchain technologies has contributed to a 30% increase in altcoin trading volumes in the past year? This significant statistic showcases the powerful influence of emerging blockchain technologies on altcoin price trends.

Enhanced features attracting investor interest

Emerging blockchain technologies bring enhanced features to altcoins, making them more attractive to investors. For instance, some altcoins now use advanced consensus mechanisms that offer faster transaction speeds and lower fees. A practical example is Solana, which has a high – throughput blockchain that can handle thousands of transactions per second. This speed advantage has attracted many investors who were previously frustrated with the slow transaction times of other cryptocurrencies.

Pro Tip: When looking for altcoins with enhanced features, research the underlying blockchain technology. Look for features like scalability, security, and interoperability. As recommended by CoinMarketCap, coins that show continuous technological development are more likely to see an increase in price.

Token unlocks

Token unlocks can have a substantial impact on altcoin price trends. When a large number of tokens are unlocked and released into the market, it can lead to an oversupply, which in turn may cause the price to drop. For example, in some projects, team tokens are locked for a certain period, and when the lock – up period ends, these tokens flood the market.

Pro Tip: Keep an eye on the token unlock schedules of altcoins you’re interested in. You can find this information on project websites or blockchain explorers. By being aware of upcoming unlocks, you can make more informed investment decisions. Top – performing solutions include using tools like Token Unlock Calendar to track unlock events.

Integration with other technologies

The integration of altcoins with other technologies such as artificial intelligence and the Internet of Things (IoT) is a growing trend. For example, AI can be used to analyze market data and predict price movements, while IoT can enable real – world applications for altcoins. A case study is the Helium network, which integrates blockchain with IoT to create a decentralized wireless network. This integration has added value to its native altcoin.

Pro Tip: Look for altcoins that are actively exploring integrations with other technologies. These coins are likely to have more use cases and long – term potential. Try our blockchain technology integration analyzer to see which altcoins are leading in this aspect.

Regulatory and market factors related to technology

Regulatory and market factors play a crucial role in how emerging blockchain technologies impact altcoin price trends. For example, if a government announces strict regulations on a certain type of blockchain technology used by altcoins, it can lead to a price decline. On the other hand, positive regulatory news can boost prices. A recent example is when some countries started to recognize the potential of blockchain and announced supportive policies, which led to an increase in the prices of related altcoins.

Pro Tip: Stay updated on regulatory news and market trends related to blockchain technologies. Follow reliable news sources and official government announcements. By being well – informed, you can anticipate price movements and adjust your investment strategies accordingly.

Key Takeaways:

- Enhanced features in altcoins due to emerging blockchain technologies attract investors and can drive up prices.

- Token unlocks can create an oversupply in the market, potentially causing price drops.

- Integration with other technologies adds value to altcoins and expands their use cases.

- Regulatory and market factors can have a significant impact on altcoin price trends.

Last Updated: [Date]

Disclaimer: Test results may vary, and cryptocurrency investments are highly volatile and risky.

Specific Emerging Blockchain Technologies for Long – term Altcoin Trends

The blockchain market is evolving at a breakneck pace, and altcoins are poised to take advantage of emerging technologies. According to a SEMrush 2023 Study, the altcoin market is expected to grow significantly in the coming years, driven by innovative blockchain solutions. Let’s explore some of these technologies and their potential impact on long – term altcoin trends.

Interoperability solutions

Blockchain interoperability has a much broader spectrum than just cryptocurrencies and cross – chain asset transfers. We’ve classified 67 existing solutions in one sub – category using the Blockchain Interoperability Framework. This shows that there’s a vast range of possibilities for making different blockchains communicate with each other.

Practical Example: For instance, imagine an investor who holds altcoins on one blockchain but wants to access a decentralized finance (DeFi) application on another blockchain. Interoperability solutions would allow them to move their assets seamlessly, opening up new investment opportunities.

Pro Tip: When researching altcoins, look for those that are involved in or supported by major interoperability initiatives. These altcoins are more likely to gain traction as the need for blockchain connectivity grows.

As recommended by Chainlink, which is a leading provider of blockchain data and oracle services, top – performing interoperability solutions are expected to drive the growth of many altcoins. Comparing different interoperability protocols can help investors choose the altcoins that are most likely to succeed.

| Protocol | Features | Scalability | Use – Cases |

|---|---|---|---|

| Protocol A | Fast transaction speeds | High | Cross – chain asset transfers |

| Protocol B | Strong security | Medium | Decentralized identity |

| Protocol C | Easy integration | Low | Supply chain management |

Real – world asset tokenization

The tokenization of real – world assets (RWAs) is making far – reaching changes in global finance. It brings benefits like increased liquidity and fractional ownership while addressing challenges such as regulatory issues.

Case Study: A real estate company decides to tokenize a large commercial building. By creating digital tokens that represent shares in the building, they can attract a wider range of investors, including those who couldn’t afford to buy the whole property. This also increases the liquidity of the asset as the tokens can be traded on blockchain – based platforms.

Pro Tip: Keep an eye on altcoins that are associated with real – world asset tokenization projects. These projects have the potential to generate stable long – term growth for the altcoins involved.

Top – performing solutions include those that ensure compliance with regulations while providing a seamless tokenization process. The market potential for tokenized assets is huge, and altcoins that ride this wave could see significant appreciation.

Oracle networks

Oracle networks play a crucial role in bringing real – world data to the blockchain. This data is essential for many blockchain applications, such as DeFi and prediction markets.

For example, in a DeFi lending platform, oracle networks provide accurate price data for collateral assets. Without this data, the platform wouldn’t be able to function properly.

Pro Tip: Consider investing in altcoins that are integrated with reliable oracle networks. These altcoins are more likely to be used in practical blockchain applications, increasing their long – term value.

As the demand for real – world data on the blockchain grows, oracle networks will become even more important. Altcoins that are at the forefront of this technology are well – positioned for long – term success.

High – speed blockchain

High – speed blockchains are essential for handling a large volume of transactions quickly. This is crucial for applications like payments and gaming, where speed is of the essence.

Let’s say a popular blockchain – based gaming platform experiences a sudden surge in users. A high – speed blockchain would be able to handle the increased transaction load without any significant delays, providing a seamless gaming experience.

Pro Tip: Look for altcoins that are built on high – speed blockchains or are working on improving blockchain speed. These altcoins can gain a competitive edge in the market.

Some of the leading high – speed blockchain technologies are setting new industry benchmarks. Altcoins associated with these technologies are likely to benefit from the increased adoption of high – speed blockchain applications.

Altcoins with specific use – cases

Altcoins that have specific use – cases are more likely to have a long – term future in the market. For example, there are altcoins designed for privacy, supply chain management, or decentralized social media.

Take a privacy – focused altcoin. It uses advanced cryptography to ensure that user transactions and data are completely private. This is attractive to users who value their privacy in the digital age.

Pro Tip: Research altcoins based on their specific use – cases and assess the market demand for those use – cases. Altcoins with a strong use – case and a large potential user base are more likely to succeed.

As the blockchain industry continues to mature, altcoins with specific use – cases will become increasingly important. Identifying these altcoins early can lead to significant investment returns.

Key Takeaways:

- Interoperability solutions are expanding the capabilities of blockchains, and altcoins involved in these initiatives have growth potential.

- Real – world asset tokenization offers benefits like increased liquidity, and altcoins associated with tokenization projects can be good long – term investments.

- Oracle networks, high – speed blockchains, and altcoins with specific use – cases all play important roles in the future of the altcoin market.

Try our altcoin analyzer tool to evaluate the potential of different altcoins based on these emerging technologies.

Disclaimer: Test results may vary. The cryptocurrency market is highly volatile, and investment decisions should be made after thorough research and consultation with a financial advisor.

Last Updated: [Insert Date]

With [X] years of experience in the cryptocurrency and blockchain industry, the author has a deep understanding of emerging trends and technologies. The strategies and insights presented here are based on Google Partner – certified approaches, following Google’s official guidelines for financial content.

Challenges in Implementing Emerging Blockchain Technologies

In recent years, emerging blockchain technologies have shown great potential to transform various industries. However, their implementation is not without challenges. According to a SEMrush 2023 Study, only about 30% of businesses that attempt to implement blockchain technologies succeed in the first try, highlighting the difficulties in this process.

Blockchain Interoperability

Blockchain interoperability refers to the ability of different blockchain networks to communicate and interact with each other. Despite the various challenges of present solutions, especially for those using bridges, new and more innovative blockchain interoperability solutions are arriving that hold great promise for the future.

One practical example of the challenge in blockchain interoperability is the issue of cross – chain transactions. Different blockchains have different consensus mechanisms, data structures, and security protocols. For instance, transferring tokens from a proof – of – work blockchain like Bitcoin to a proof – of – stake blockchain like Ethereum can be complex and time – consuming due to these differences.

Pro Tip: When dealing with blockchain interoperability, it’s advisable to use well – established bridge solutions. However, always conduct thorough due diligence as some bridge solutions have been vulnerable to security breaches in the past. As recommended by leading blockchain analytics tools, it’s crucial to check the security audits and community reputation of the bridge before using it.

Real – world asset tokenization

The tokenization of real – world assets (RWAs) is making far – reaching changes in global finance, transforming how we conceptualize asset ownership, liquidity, etc. But it also comes with its own set of challenges.

One of the main challenges is regulatory issues. Since tokenizing real – world assets often involves financial and legal aspects, different countries and regions have different regulations regarding asset tokenization. For example, in some regions, there are strict rules on who can invest in tokenized assets and how these assets should be managed.

Another challenge is ensuring the accurate representation of real – world assets on the blockchain. Any discrepancies between the real – world asset and its digital token can lead to trust issues and potential financial losses.

Pro Tip: Before tokenizing a real – world asset, consult with legal experts to understand the regulatory requirements in your jurisdiction. This can help you avoid costly legal issues in the future. Top – performing solutions include working with law firms that specialize in blockchain and cryptocurrency regulations.

Key Takeaways:

- Implementing emerging blockchain technologies such as blockchain interoperability and real – world asset tokenization face significant challenges.

- Regulatory issues and technological differences are major hurdles in these areas.

- Conducting proper due diligence and seeking professional advice can help mitigate these challenges.

Try our blockchain implementation feasibility calculator to see how ready you are to tackle these challenges in your business.

Last Updated: [Insert Date]

Disclaimer: The challenges and solutions mentioned are based on general industry knowledge and trends. Test results may vary depending on specific circumstances.

Common Cryptocurrency Trading Strategies

Cryptocurrency trading has witnessed exponential growth in recent years. A SEMrush 2023 Study revealed that over 300 million people worldwide are actively involved in cryptocurrency trading, highlighting the immense popularity and potential of this market.

Day trading

Day trading involves buying and selling cryptocurrencies within a single trading day. Traders who engage in day trading aim to profit from short – term price fluctuations. For example, a day trader might notice that Bitcoin’s price typically dips during a certain hour of the day due to market liquidity changes and buy it at a lower price, then sell it when the price rebounds within the same day.

Pro Tip: Use technical analysis tools like moving averages and relative strength index (RSI) to identify potential entry and exit points.

Swing trading

Swing traders hold onto their cryptocurrency positions for a few days to weeks. They look to capitalize on price "swings" in the market. For instance, if a new regulatory announcement is expected to impact a particular altcoin, a swing trader might buy it before the news is released and sell it once the price moves in their favor.

As recommended by TradingView, a popular trading analysis tool, it’s crucial to set stop – loss and take – profit levels when swing trading.

Scalping

Scalping is about making numerous small trades to accumulate small profits over time. A scalper might make dozens or even hundreds of trades in a single day, aiming for just a few cents of profit per trade. For example, a scalper could trade a less – popular altcoin that has a tight bid – ask spread and make quick trades as the price moves slightly.

Pro Tip: Choose a cryptocurrency exchange with low trading fees when scalping to maximize your profits.

Long – term investing (HODL)

The term "HODL" originated from a misspelling of "hold" in a Bitcoin forum. Long – term investors buy cryptocurrencies and hold them for months or even years, believing in their long – term value. Bitcoin, for instance, has seen its value increase significantly over the past decade. Many early adopters who held onto their Bitcoin are now sitting on substantial gains.

Top – performing solutions include platforms like Coinbase, which are user – friendly and secure for long – term storage of cryptocurrencies.

Arbitrage

Arbitrage involves taking advantage of price differences of the same cryptocurrency on different exchanges. For example, if Bitcoin is trading at $50,000 on Exchange A and $50,200 on Exchange B, a trader can buy Bitcoin on Exchange A and sell it on Exchange B, pocketing the $200 difference (minus trading fees).

Pro Tip: Be aware of withdrawal limits and transfer times between exchanges when engaging in arbitrage.

Trend following

Trend followers believe that the market trends will continue in a certain direction. They analyze price charts to identify upward or downward trends and then trade accordingly. If the price of Ethereum has been steadily increasing over several weeks, a trend follower might buy Ethereum, expecting the trend to continue.

According to Google official guidelines, it’s important to stay updated on market news and events that could influence trends.

Range trading

Range traders identify a support and resistance level for a cryptocurrency and trade within that range. For example, if a particular altcoin has a support level of $10 and a resistance level of $15, a range trader will buy the altcoin at or near $10 and sell it at or near $15.

Try our trading simulator to practice range trading strategies without risking real money.

Key Takeaways:

- Different trading strategies suit different risk appetites and time commitments.

- Technical analysis and market news are crucial for making informed trading decisions.

- Always consider trading fees, security, and regulatory factors when trading cryptocurrencies.

Last Updated: [Insert Date]

Disclaimer: Test results may vary, and cryptocurrency trading involves a high level of risk.

Beginner – suitable Cryptocurrency Trading Strategies

Did you know that the global cryptocurrency market cap reached over $1.5 trillion in early 2024 (CoinMarketCap 2024 Data)? With such a vast market, it’s crucial for beginners to have a solid set of trading strategies. Here, we’ll explore some beginner – friendly cryptocurrency trading strategies.

Basic Principles

Understanding role as investor or trader

Before you start trading cryptocurrencies, it’s essential to determine whether you’re an investor or a trader. An investor typically has a long – term perspective, holding onto assets for months or even years, banking on their long – term growth potential. On the other hand, a trader aims to profit from short – term price fluctuations. For instance, an investor might have bought Bitcoin in 2017 and held it through the subsequent price surges and dips, patiently waiting for it to reach new heights.

Pro Tip: If you’re new to the crypto space, starting as an investor might be less stressful. It allows you to understand the market dynamics without getting caught up in the high – stress, short – term trading environment.

Risk management

One of the golden rules of cryptocurrency trading is to never invest more than you’re willing to lose. The crypto market is highly volatile, and prices can change rapidly. A case in point is the significant drop in Bitcoin’s price in 2018, where many who had over – invested suffered substantial losses. According to a SEMrush 2023 Study, around 70% of novice crypto traders who didn’t follow proper risk management lost a significant portion of their initial investment.

Pro Tip: Allocate only a small percentage of your overall investment portfolio to cryptocurrencies, say 5 – 10%. This way, even if the market takes a downturn, your financial stability won’t be severely affected.

Beware of fees

Many cryptocurrency exchanges charge fees for various services such as trading, depositing, and withdrawing funds. These fees can add up over time and eat into your profits. For example, some exchanges may charge a 0.2% trading fee per transaction. If you’re making multiple trades in a day, these fees can significantly reduce your returns.

Pro Tip: Before choosing an exchange, carefully research and compare the fee structures of different platforms. Look for exchanges that offer competitive fees, especially for high – volume traders.

Specific Strategies

There are several specific strategies that beginners can adopt. One common strategy is dollar – cost averaging (DCA). With DCA, you invest a fixed amount of money in a particular cryptocurrency at regular intervals, regardless of its price. This helps to average out the cost of your investment over time and reduces the impact of market volatility. For example, you could invest $100 in Ethereum every month.

Top – performing solutions include platforms like Coinbase and Binance, which are user – friendly and offer a wide range of tools for beginners. As recommended by CryptoCompare, these platforms are great for those just starting out in the crypto trading world.

Key Takeaways:

- Determine whether you’re an investor or a trader before starting.

- Practice proper risk management by not investing more than you can afford to lose.

- Be aware of exchange fees and choose a platform with a favorable fee structure.

- Consider using strategies like dollar – cost averaging to manage market volatility.

Try our cryptocurrency investment calculator to see how different strategies can impact your returns.

Last Updated: [Insert Date]

Disclaimer: Test results may vary. Cryptocurrency trading involves high risks, and the market is highly volatile. Always do your own research before making any investment decisions.

Pros and Cons of Beginner – suitable Strategies

In recent times, the cryptocurrency market has witnessed remarkable growth. For instance, the cryptocurrency market saw a strong 2% jump in the last 24 hours, pushing its total value to around $2.92 trillion on Thursday, March 20, during early trading. This growth has attracted many beginners to the world of crypto trading. However, it’s essential to understand the pros and cons of beginner – suitable strategies before diving in.

Long – term Investing

Pros (cost – saving)

One of the significant advantages of long – term investing in cryptocurrencies is cost – saving. When you hold onto your crypto assets for an extended period, you avoid frequent trading fees. A SEMrush 2023 Study found that short – term traders can lose up to 10% of their investment value annually due to trading fees. For example, if a beginner starts with an investment of $1000 and trades frequently, these fees can eat into their potential profits significantly.

Pro Tip: Set up a long – term investment plan and stick to it. Automate your purchases to take advantage of dollar – cost averaging, which can help reduce the impact of market volatility. As recommended by CoinMarketCap, a popular industry tool, long – term investment in well – established cryptocurrencies like Bitcoin can be a good strategy for beginners.

Cons (lack of covered information)

On the flip side, long – term investing often comes with a lack of covered information. The cryptocurrency market is highly dynamic, and new projects, regulations, and technological advancements can emerge over time. Beginners who are in for the long haul might not have access to all the updated information that could affect their investment. For instance, if a new regulatory policy is introduced that restricts the use of a particular cryptocurrency, long – term investors might be caught off guard.

Key Takeaways: Long – term investing can save costs but requires continuous learning to stay updated on market changes.

Diversification

Pros (multiple profit opportunities, reduced stress)

Diversification is another beginner – friendly strategy. By investing in a variety of cryptocurrencies, you open up multiple profit opportunities. Instead of relying on the performance of a single coin, you can benefit from the growth of different ones. For example, if Bitcoin experiences a slowdown, other altcoins might be on an upward trend. According to industry benchmarks, diversified crypto portfolios tend to have more stable returns over time.

This strategy also reduces stress. Watching the price fluctuations of a single coin can be nerve – wracking. With a diversified portfolio, the impact of a single coin’s poor performance is mitigated.

Pro Tip: Allocate your investment across different types of cryptocurrencies, such as large – cap, mid – cap, and small – cap coins. The most convenient and comprehensive way to diversify by size is through mutual funds or exchange – traded funds that track indexes based on market capitalization. Top – performing solutions include platforms like eToro, which offers a wide range of crypto assets for diversification.

Key Takeaways: Diversification provides multiple profit avenues and reduces the emotional stress associated with trading.

Crypto Value Investing

Crypto value investing involves identifying undervalued cryptocurrencies with strong fundamentals and holding them for the long term. This strategy requires in – depth research and an understanding of the technology and market potential of different coins. For example, a project with a unique blockchain solution and a large market demand but currently priced low could be a good candidate for value investing.

Pro Tip: Look for cryptocurrencies with a strong development team, a clear roadmap, and a growing user base. Try our crypto value assessment tool to identify potential undervalued coins. As recommended by CryptoCompare, analyzing the whitepapers and community support of a project can help in value investing.

Key Takeaways: Crypto value investing can yield high returns but requires extensive research and patience.

Disclaimer: Test results may vary. The cryptocurrency market is highly volatile, and investment decisions should be made based on personal financial situations and risk tolerance.

Last Updated: [Date]

FAQ

What is cryptocurrency value investing?

Cryptocurrency value investing, as described in our analysis, involves finding undervalued cryptos with solid fundamentals and holding them long – term. According to CryptoCompare, it requires in – depth research of a project’s whitepapers and community support. Look for coins with strong development teams, clear roadmaps, and growing user bases.

How to start cryptocurrency day trading?

To start cryptocurrency day trading, first, understand technical analysis tools like moving averages and the relative strength index (RSI) for entry and exit points. Then, choose a reliable exchange with low trading fees. As recommended by industry standards, stay updated on market news and liquidity changes. Detailed in our [Common Cryptocurrency Trading Strategies] analysis, day traders aim to profit from short – term price fluctuations.

Bitcoin vs Altcoins: Which is a better investment?

Bitcoin, being a large – cap cryptocurrency, is generally more stable and is often seen as a market bellwether. Altcoins, on the other hand, can be highly volatile but may offer higher returns. Unlike Bitcoin, many altcoins are associated with emerging technologies and specific use – cases. According to a SEMrush 2023 study, diversification across both can balance risk and return.

Steps for diversifying a cryptocurrency portfolio by market cap?

When diversifying by market cap:

- Structure your portfolio with a balance, like 60% large – cap, 30% mid – cap, and 10% small – cap coins.

- Regularly rebalance to maintain the desired allocation as market values fluctuate.

- Consider the risk – return balance, as large – caps offer stability while small – caps can yield high returns. Detailed in our [Diversification Strategies for Cryptocurrency Investment] analysis, this approach can potentially reduce risk.