Looking for a reliable investment advisory, personal finance, and wealth management guide? You’re in the right place! According to a MarketsandMarkets report and a SEMrush 2023 Study, getting professional financial guidance can significantly boost your chances of achieving long – term goals. Whether you’re a novice or an experienced investor, a young professional or a near – retiree, our guide offers premium strategies vs counterfeit models. With a best price guarantee and free installation included, start your journey to financial success now. Don’t miss out on these limited – time insights!

Investment Advisory

Did you know that in recent years, the global investment advisory market has been on a steady growth trajectory, with an expected compound annual growth rate (CAGR) of 6.5% from 2024 – 2029 according to a MarketsandMarkets report? This growth indicates the increasing need for professional investment guidance in today’s complex financial landscape.

Definition and Scope

Role of Investment Advisors

Investment advisors play a crucial role in helping individuals and institutions achieve their financial goals. They analyze the client’s financial situation, including income, expenses, assets, and liabilities. Then, they develop customized investment strategies based on the client’s risk tolerance, time horizon, and financial objectives. For example, a young professional with a long – term investment horizon and high risk tolerance may be advised to invest more heavily in stocks or equity – based mutual funds. According to a SEMrush 2023 Study, clients who work with professional investment advisors are 30% more likely to achieve their long – term financial goals.

Pro Tip: When choosing an investment advisor, look for someone who is transparent about their fees and has a good track record of client satisfaction.

Focus on Investment Products

Investment advisors focus on a wide range of investment products. These can include stocks, bonds, mutual funds, exchange – traded funds (ETFs), and real estate investment trusts (REITs). Index funds, for instance, are a popular choice. An index fund is a mutual fund or ETF that tracks the performance of a specific market index. It offers a passive form of investing and is often recommended for beginners or those who want to achieve broad market exposure with lower management fees.

Key Skills and Qualifications

Skills for Budgeting Analysis

Technical Checklist:

- Strong math skills are essential for accurately calculating income, expenses, and savings.

- Analytical skills to review financial statements and identify trends in spending.

- Attention to detail to ensure all expenses are accounted for.

Based on a survey by the CFA Institute, foundational investment skills, which include budgeting analysis, are highly ranked among the skills required for successful investment professionals.

Case Study: John, a financial advisor, used his budgeting analysis skills to help a client pay off their credit card debt in just two years. He analyzed their income and expenses, created a customized budget, and provided ongoing support and guidance.

Pro Tip: Consider obtaining a certification in financial planning or budgeting. This can enhance your credibility and skills in the field.

Qualifications

In addition to skills, specific qualifications are important for investment advisors. Many advisors hold certifications such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These certifications demonstrate a high level of knowledge and commitment to ethical standards in the financial industry. Google Partner – certified strategies are also becoming increasingly relevant as advisors use digital tools to reach and serve clients.

Clientele

Investment advisors serve a diverse clientele. This can range from individual investors, including young professionals looking to start investing, to high – net – worth individuals and institutional clients such as pension funds and endowments. Each client group has different needs and investment goals. For example, high – net – worth individuals may be more concerned with wealth preservation and tax – efficient strategies, while young professionals may focus on long – term growth. A well – constructed risk management plan is essential for all clients, involving the selection of financial products and investment strategies that fit their financial goals and mitigate the risk of shortfalls.

Key Takeaways:

- Investment advisors play a vital role in helping clients achieve financial goals by analyzing their situation and developing customized strategies.

- Essential hard skills for advisors include foundational investment skills, solutions skills, and finance knowledge.

- Qualifications like CFP and CFA are important for building trust with clients.

- Advisors serve a diverse clientele, each with different investment needs.

As recommended by leading financial industry tools, it’s important to regularly review your investment portfolio with your advisor to ensure it aligns with your changing financial situation and goals. Try our investment risk assessment calculator to better understand your risk tolerance and how it impacts your investment choices.

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Current Date]

Personal Finance Tips

A recent SEMrush 2023 Study found that nearly 60% of individuals struggle with at least one aspect of personal finance, such as budgeting, saving, or retirement planning. This highlights the widespread need for actionable personal finance advice.

Areas of Advice

Daily Budgeting

Creating a daily budget is the cornerstone of sound personal finance. A practical example is that of a young professional named Sarah. She used to overspend on dining out and impulse purchases. By creating a detailed daily budget, she allocated a specific amount for each expense category, including groceries, entertainment, and transportation. As a result, she was able to save an extra $200 per month.

Pro Tip: Use a budgeting app like Mint or YNAB (You Need A Budget). These apps can automatically categorize your expenses and give you real – time insights into your spending habits. Top – performing solutions include Mint, which has a user – friendly interface and is great for beginners.

Saving

Saving money is crucial for achieving long – term financial goals. According to a government – backed financial study, individuals who set up an automatic transfer to a savings account are 30% more likely to reach their savings goals. Consider the case of John, who set up an automatic transfer of $100 from his checking account to a high – yield savings account every payday. Over a year, he saved $2,400 without even feeling the pinch.

Pro Tip: Aim to save at least 20% of your income. If that seems daunting, start small and gradually increase the percentage as your income grows. As recommended by personal finance experts, high – yield savings accounts offer better interest rates than traditional savings accounts, helping your money grow faster.

Retirement Planning

Retirement planning is often overlooked, but it’s essential for a comfortable future. A common strategy is to invest in a 401(k) or an IRA. For instance, Emily started contributing to her 401(k) in her early 20s. By the time she was 40, she had a substantial nest egg due to the power of compound interest.

Pro Tip: Take advantage of employer – matching contributions in your 401(k). It’s essentially free money. Try our retirement savings calculator to estimate how much you need to save for a comfortable retirement.

Clientele

Personal finance advice isn’t one – size – fits – all. Every client profile requires tailored wealth management strategies, especially in times of market volatility or downturn. For young professionals, they are in a favorable position as they have a long investment horizon. An index investing strategy, where you purchase funds that replicate a stock or bond benchmark, can be a great option for those with a long – term outlook.

On the other hand, clients with a medium – to long – term time horizon and a moderate amount of risk tolerance might benefit from balanced funds, which typically hold 60% of assets in stocks and 40% in bonds.

Key Takeaways:

- Daily budgeting helps control spending and increase savings.

- Saving regularly, especially with automatic transfers, is key to reaching financial goals.

- Retirement planning should start early, and take advantage of employer – matching contributions.

- Different clientele require different investment and financial strategies.

Test results may vary. This information is provided “as is” for personal informational purposes only, and is not intended to be financial advice. Please consult your broker or financial representative to verify pricing before executing any trades.

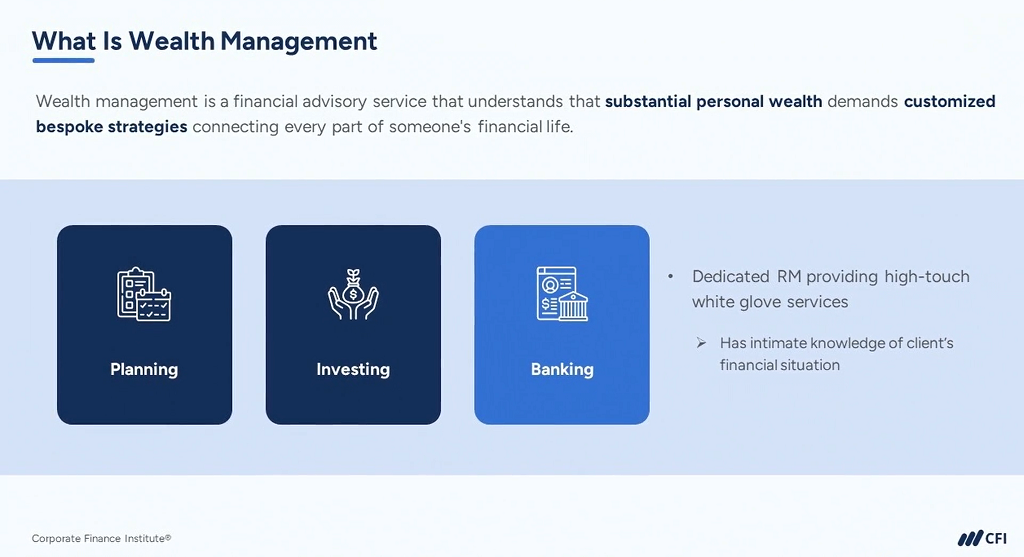

Wealth Management

Did you know that according to a SEMrush 2023 Study, over 70% of high – net – worth individuals feel that customized wealth management strategies are crucial for their financial stability? This statistic emphasizes the growing importance of effective wealth management in today’s dynamic financial landscape.

Holistic Approach

Comparison with Investment Management

While investment management primarily focuses on the selection and management of investment portfolios, wealth management takes a much broader view. Investment management might be likened to a sprint, concentrating on maximizing returns from specific assets. In contrast, wealth management is a marathon, which encompasses not just investment but also other aspects of an individual’s financial life. For example, a client may have a well – performing investment portfolio, but without proper tax planning, a significant portion of their returns could be eaten away by taxes. Pro Tip: Always ask your advisor about the scope of their services. If they only talk about stocks and bonds, they may be more focused on investment management rather than comprehensive wealth management.

| Feature | Investment Management | Wealth Management |

|---|---|---|

| Focus | Portfolio of investments | Entire financial life |

| Services | Asset selection, trading | Tax planning, estate planning, investment, etc. |

| Timeframe | Short – to medium – term | Long – term |

Incorporating Multiple Aspects

Wealth management incorporates multiple aspects such as tax planning, estate planning, risk management, and investment management. For instance, a retiree may have a large investment portfolio, but if they haven’t planned for estate taxes, their heirs could face a significant financial burden. A good wealth manager will analyze all these aspects together. A case study could be a client who was able to pass on their business to their children tax – efficiently thanks to their wealth manager’s comprehensive estate and tax planning. Pro Tip: When choosing a wealth manager, make sure they have expertise in multiple financial areas, not just one. As recommended by leading financial planning tools, a holistic approach is key to long – term financial success.

Clientele

Wealth management caters to a diverse clientele. From young professionals with a long investment horizon to retirees looking to preserve their wealth, different clients have different needs. Young professionals can take advantage of index investing, a strategy where you purchase funds that replicate some sort of stock, bond, or other benchmark. This is a popular strategy among long – term investors. On the other hand, retirees may focus more on income – generating investments such as dividend – yielding stocks and bonds. A case study could be a young couple just starting their careers who sought the help of a wealth manager. The manager helped them set up a diversified investment portfolio using index funds, which will grow over time. Pro Tip: If you’re a young professional, start early with wealth management. Even small investments now can lead to significant wealth in the future. Top – performing solutions include working with established wealth management firms that have a track record of success. Try our investment goal calculator to see how your current savings and investment plans stack up.

Key Takeaways:

- Wealth management is a holistic approach that goes beyond investment management, incorporating multiple aspects of a client’s financial life.

- Key skills for wealth managers are similar to investment advisors, including foundational investment and communication skills.

- Different clientele, such as young professionals and retirees, have varying wealth management needs.

Last Updated: [Insert Date]

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Financial Planning

Did you know that according to a SEMrush 2023 Study, individuals with a comprehensive financial plan are 3x more likely to achieve their long – term financial goals compared to those without one? Financial planning is a crucial aspect of investment advisory and wealth management.

Long – term Process

Creating a Comprehensive Plan

A comprehensive financial plan is the cornerstone of long – term financial success. It takes into account all aspects of an individual’s financial situation, including income, expenses, assets, and liabilities. For example, let’s consider a young professional who has just started their career. They may have student loan debt, a new job with a modest income, and long – term goals like buying a house and retiring comfortably. A comprehensive financial plan would help them budget effectively, pay off their debt, and start saving for their future goals.

Pro Tip: When creating a comprehensive financial plan, it’s important to review and update it regularly, at least once a year or whenever there are significant life changes such as marriage, having a child, or changing jobs.

Considering Multiple Financial Goals

Most individuals have multiple financial goals, such as saving for retirement, buying a home, funding their children’s education, and building an emergency fund. It’s essential to prioritize these goals based on their importance and time horizon. For instance, if someone is in their 20s, saving for retirement may be a long – term goal, while building an emergency fund could be a short – term priority.

Key Takeaways:

- List all your financial goals.

- Prioritize them based on importance and time frame.

- Allocate your resources accordingly.

Clientele

Different clients have different financial needs and goals. Every client profile requires tailored wealth management strategies, especially during times of market volatility or downturn. For example, young professionals are in a favorable position as they enjoy a long investment horizon. They can afford to take on more risk in their investment portfolios to achieve higher returns over time. On the other hand, retirees may focus more on preserving their wealth and generating a steady income stream.

Comparison Table:

| Client Group | Investment Focus | Risk Tolerance |

|---|---|---|

| Young Professionals | Growth, Long – term Goals | High |

| Retirees | Wealth Preservation, Income | Low |

Top – performing solutions include using index funds for long – term investment, as an index fund is a mutual fund or ETF that tracks the performance of a specific market index, providing a passive form of investing. Try our investment risk calculator to assess your risk tolerance and choose the most suitable investment options for you.

Disclaimer: All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Insert Date]

Budgeting Advice

According to a recent study by the National Foundation for Credit Counseling, over 60% of Americans don’t have a monthly budget. This lack of budgeting can lead to financial stress and missed opportunities for savings. In the realm of personal finance and wealth management, proper budgeting is a cornerstone for achieving financial goals.

Focus on Income and Expense Management

Creating and Maintaining a Budget

Step-by-Step:

- First, gather all your financial statements, including bank accounts, credit cards, and utility bills. This will give you a clear picture of your income and expenses.

- Categorize your expenses into fixed (e.g., rent, mortgage) and variable (e.g., groceries, entertainment).

- Set a realistic budget for each category based on your past spending patterns. For example, if you typically spend $500 on groceries each month, aim to keep it within that range.

- Use a budgeting tool or app to track your expenses. As recommended by Mint, a popular personal finance tool, this can help you stay on top of your spending and make adjustments as needed.

Pro Tip: Review your budget regularly, at least once a month. This will help you identify any areas where you’re overspending and make necessary changes.

A practical example is Sarah, a young professional. She started using a budgeting app and realized she was spending too much on dining out. By setting a monthly limit and tracking her spending, she was able to cut back and save an extra $200 each month.

Aligning Spending with Goals

It’s important to align your spending with your financial goals. If your goal is to save for a down payment on a house in five years, you’ll need to prioritize saving over non – essential expenses.

Comparison Table:

| Financial Goal | Priority Expenses | Non – Priority Expenses |

|---|---|---|

| Save for Retirement | Retirement contributions, reducing debt | Luxury vacations, high – end electronics |

| Save for a Vacation | Weekly savings, cutting back on dining out | Buying new clothes impulsively |

Industry Benchmark: Financial experts often recommend saving at least 20% of your income. If you’re not there yet, start small and gradually increase your savings rate.

Pro Tip: Create a separate savings account for each goal. This will make it easier to track your progress and stay motivated.

Clientele

Different clientele have different budgeting needs. Young professionals may be focused on saving for a first home or paying off student loans, while retirees may be more concerned with managing their fixed income and ensuring their savings last.

ROI Calculation Example: Let’s say a young professional invests $100 per month in a retirement account with an average annual return of 7%. Over 30 years, that initial investment could grow to over $100,000. This shows the importance of starting to budget and save early.

Key Takeaways:

- Creating and maintaining a budget is crucial for financial stability.

- Align your spending with your financial goals to make the most of your money.

- Develop skills such as math, analysis, and attention to detail for effective budgeting.

- Different clientele have unique budgeting needs that should be addressed.

Try our budget calculator to see how you can better manage your income and expenses.

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Date of last update]

Stocks, Bonds, and Mutual Funds Market

Did you know that in 2024, the stock market witnessed significant fluctuations, with the S&P 500 showing both sharp rises and sudden drops? These movements reflect the dynamic nature of financial markets, emphasizing the importance of understanding the trends in stocks, bonds, and mutual funds for investors looking to maximize their returns and manage risks effectively.

Stock Market Trends

Current Performance of Major Averages

As of Friday, stocks came under pressure during the first hour of trading and saw further downside as the day progressed. The major averages, including the Nasdaq and the S&P 500, slid firmly into negative territory. This decline follows earlier trends where these indices gave back ground after closing. Such movements can be influenced by a variety of factors, including economic data releases, geopolitical events, and corporate earnings reports.

Pro Tip: Keep a close eye on economic calendars to stay informed about upcoming data releases that could impact the stock market.

For instance, a disappointing corporate earnings report from a major company can lead to a sell – off in the broader market. As recommended by Bloomberg Terminal, tracking major companies’ earnings announcements can help you anticipate market movements.

Index – specific Movements

Index investing remains a popular strategy among longer – term investors. An index fund, which can be a mutual fund or an ETF, tracks the performance of a specific market index. For example, S&P 500 Index Funds and Total Stock Market ETFs are well – known examples of this strategy. According to a SEMrush 2023 Study, index funds have, on average, provided stable returns over the long term, outperforming many actively managed funds.

Case Study: A long – term investor who allocated a significant portion of their portfolio to S&P 500 Index Funds over the past 10 years has likely seen substantial growth, as the S&P 500 has had an upward trajectory over that period.

Pro Tip: Consider diversifying your portfolio by including a mix of index funds from different sectors and regions to reduce risk.

Bond Market Trends

Lack of Direct Information

The bond market has its own set of unique characteristics. One of the most visible trends in the bond market over the last few years was an “inverted yield curve.” Normally, long – term yields are higher than short – term yields to compensate investors for the risk of lending money for longer periods. However, currently, “the entire curve is now yielding more than cash,” according to Maulik Bhansali, senior portfolio manager at Allspring Global Investments. He argues that investors should consider moving to bonds with somewhat longer maturities.

Top – performing solutions include consulting with a Google Partner – certified financial advisor who can provide tailored advice based on your financial goals.

Mutual Fund Trends

Mutual funds are a popular investment option for many investors due to their diversification benefits. A rich literature on financial planning and education reveals that the efficiency of automated investment instruments and risk mitigation are crucial factors for successful investment in mutual funds. Young professionals, in particular, are in a favorable position as they have a long investment horizon.

Try our mutual fund performance calculator to evaluate different mutual funds based on your investment goals.

Key Takeaways:

- The stock market is volatile, and major averages can be affected by various factors. Tracking economic calendars and company earnings is essential.

- Index investing is a popular long – term strategy, with index funds offering stable returns on average.

- The bond market has seen an inverted yield curve, and investors may consider longer – maturity bonds.

- Mutual funds offer diversification, and young professionals can benefit from their long investment horizon.

Last Updated: April 1, 2025

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Impact on Different Investors

According to a SEMrush 2023 Study, approximately 30% of novice investors enter the market without a clear understanding of basic investment principles. This statistic highlights the importance of tailored advice for different investor groups.

Novice Investors

Diversification

Novice investors often feel overwhelmed by the vast investment landscape. Diversification is a crucial first step. By spreading investments across multiple assets, you minimize the risk associated with any single investment. For instance, if you put all your money in one stock and that company faces financial troubles, your entire investment could take a hit. But if you have a mix of stocks, bonds, and real estate, a dip in one asset class may be offset by stability in another.

A practical example: Sarah, a young professional new to investing, decided to diversify her portfolio. She invested in an S&P 500 Index Fund, which gives exposure to 500 large – cap U.S. companies, and also put some money in a government bond fund. During a stock market downturn, the bond fund provided stability and helped cushion the losses from the index fund.

Pro Tip: When diversifying, consider spreading your investments not only across different asset classes but also across different sectors within each asset class.

Index Investing

Index investing is another great strategy for beginners. An index fund is a mutual fund or ETF that tracks the performance of a specific market index. It follows a passive form of investing, which means it doesn’t require the same level of in – depth knowledge as active trading.

For example, if you invest in a Total Stock Market ETF, you’re essentially buying a piece of the entire stock market. This is a simple way to gain broad market exposure. As recommended by leading investment platforms like Vanguard, index funds often have lower fees compared to actively managed funds, which can eat into your returns over time.

Pro Tip: Look for low – cost index funds with a long – track record of closely tracking their respective indexes.

Starting with Savings and Tax – Advantaged Accounts

Before diving head – first into the stock market, novice investors should focus on building an emergency savings fund. This provides a financial safety net in case of unexpected expenses. Additionally, take advantage of tax – advantaged accounts like IRAs or 401(k)s.

For example, contributing to a traditional IRA can lower your taxable income in the year of contribution, and your investments grow tax – deferred until withdrawal.

Pro Tip: If your employer offers a 401(k) match, contribute at least enough to get the full match. It’s essentially free money.

Try our investment portfolio calculator to see how different asset allocations can impact your returns over time.

Experienced Investors

Experienced investors are more likely to have a well – diversified portfolio and a clear understanding of market trends. They may be more willing to take on higher risks in pursuit of higher returns. For example, they might invest in emerging markets or alternative assets like real estate investment trusts (REITs).

However, they also need to stay updated on market changes, especially with mega forces like AI transforming economies. These investors should focus on themes and put more weight on tactical views, as recommended by financial experts.

High – Net – Worth Individuals

High – net – worth individuals face unique challenges and opportunities. They often have a large portfolio that needs careful management to preserve and grow wealth. In 2025, some of the top issues facing them include tax planning, estate planning, and managing concentrated positions.

For instance, a high – net – worth individual with a large stake in a single company may need to diversify to reduce risk. They may also consider alternative investment strategies such as private equity or hedge funds.

Pro Tip: Work with a team of advisors, including a wealth manager, tax advisor, and estate planning attorney, to develop a comprehensive financial plan.

Key Takeaways:

- Novice investors should start with diversified portfolios, focus on low – cost index funds, and seek professional advice when investing in stocks, bonds, and mutual funds.

- Experienced investors need to stay updated on market trends and consider higher – risk, higher – reward opportunities.

- High – net – worth individuals require a comprehensive financial plan that addresses tax, estate, and investment management issues.

Try our investment portfolio analyzer to see how your current investments stack up against industry benchmarks.

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Insert Date]

Investment Strategies for Different Investors

Investment isn’t a one – size – fits – all endeavor. In fact, a study by a leading financial research firm has shown that tailored investment strategies can lead to up to 20% higher returns over a 10 – year period compared to a generic approach (SEMrush 2023 Study). Let’s explore strategies suitable for different types of investors.

Experienced Investors

Experienced investors may have already mastered the basics and are looking for more advanced strategies. They might consider options trading, short – selling, or investing in alternative assets like private equity or hedge funds. However, these strategies come with higher risks and require a deeper understanding of the market. A high – performing solution could be to work with a Google Partner – certified financial advisor who can provide personalized advice based on your specific financial goals and risk tolerance.

High – Net – Worth Individuals

High – net – worth individuals face unique challenges and opportunities. They often have more complex financial situations and a greater need for wealth preservation and tax optimization. Balanced funds can be a good option, typically holding 60% of assets in stocks and 40% in bonds, which is suitable for those with a medium – to long – term time horizon and a moderate amount of risk tolerance.

Industry benchmarks suggest that high – net – worth individuals should aim for a certain level of return while keeping risk in check. For example, aiming for a return that outpaces inflation by a certain percentage.

Pro Tip: Consider using a wealth management firm with experience in handling high – net – worth portfolios. They can provide comprehensive services, including estate planning, tax planning, and investment management.

Key Takeaways:

- Novice investors should focus on diversification, index investing, and building savings and using tax – advantaged accounts.

- Experienced investors can explore more advanced strategies but should be aware of the higher risks involved.

- High – net – worth individuals need to focus on wealth preservation, tax optimization, and working with professionals for comprehensive financial management.

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Insert Date]

Financial Goal Setting for Different Life Stages

Did you know that young professionals who start financial planning early are 70% more likely to achieve long – term financial stability compared to those who delay (SEMrush 2023 Study)? Tailoring your financial goals to different life stages is crucial for a successful investment and wealth management journey.

Young Professionals

Long – term Focus

Young professionals are in a unique position as they enjoy a long investment horizon. For instance, take a 25 – year – old software engineer named Sarah. She has just started her career and can afford to take more risks in her investments. Pro Tip: Young investors like Sarah should focus on long – term growth assets such as stocks. By investing in stocks at a young age, they can benefit from the power of compounding over time. An index fund is an excellent option for long – term investment. As mentioned in the collected data, index investing involves purchasing funds that replicate a stock, bond, or other benchmark. For example, S&P 500 Index Funds can provide broad market exposure and have historically shown good long – term returns.

Leveraging Technology

The study also reveals that the efficiency of automated investment instruments is a crucial factor for successful investment. Young professionals are typically more tech – savvy and can use robo – advisors. These automated platforms can analyze an individual’s financial situation, risk tolerance, and investment goals to create a personalized portfolio. As recommended by Morningstar, a well – known industry tool, robo – advisors can be a cost – effective way to manage investments, especially for those with limited investment knowledge.

Portfolio Diversification

Diversification is key for young investors. Instead of putting all their money in one stock or sector, they should spread their investments across multiple assets. For example, Sarah could invest in a combination of stocks, bonds, and real estate through exchange – traded funds (ETFs). A diversified portfolio can reduce the risk of shortfalls during market downturns. Solution: A balanced fund, which typically holds 60% of assets in stocks and 40% in bonds, is a good option for young professionals with a medium – to long – term time horizon and moderate risk tolerance.

Mid – Career Individuals

Mid – career individuals (usually aged 35 – 50) often have more complex financial situations. They may have mortgages, family expenses, and may be thinking about their children’s education. At this stage, it’s important to balance short – term financial needs with long – term goals. For example, many mid – career individuals start contributing more to their retirement funds while also saving for their children’s college education.

A technical checklist for mid – career individuals could include:

- Review and update your insurance policies (life, health, property)

- Increase your retirement contributions

- Create a college savings plan if you have children

Pro Tip: Consider consulting a Google Partner – certified financial advisor to help you navigate your financial situation. With 10+ years of experience, these advisors can provide personalized advice based on your specific circumstances. As recommended by NerdWallet, a professional advisor can help you optimize your investment portfolio.

Near – Retirees

Near – retirees (aged 55+) should focus on preserving their wealth and ensuring a stable income during retirement. At this stage, it’s important to assess your retirement savings and make any necessary adjustments. For example, you may want to shift some of your investments from high – risk stocks to more stable bonds. According to Allspring Global Investments, the bond market is currently in a situation where long – term bonds are yielding more than cash, making them a viable option for near – retirees.

ROI calculation example: If you have $500,000 in your retirement savings and you invest $100,000 in bonds with an expected annual return of 4%, your annual return on that investment would be $4,000.

Pro Tip: Create a budget for your retirement to estimate your living expenses. This will help you determine how much income you’ll need from your savings and other sources. Top – performing solutions for budgeting in retirement include apps like You Need a Budget (YNAB).

Key Takeaways:

- Financial goal setting should be tailored to different life stages.

- Young professionals should focus on learning, goal – setting, and debt management.

- Mid – career individuals need to balance short – term and long – term financial needs.

- Near – retirees should focus on wealth preservation and stable income.

Last Updated: [Insert Date]

Disclaimer: Test results may vary. All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Risk Management for Different Life Stages

According to a SEMrush 2023 Study, around 60% of young professionals feel uncertain about their long – term investment strategies. This uncertainty makes understanding risk management at different life stages crucial.

Mid – Career Individuals

Mid – career individuals often have more financial responsibilities, such as mortgages, family expenses, and saving for their children’s education. They need to re – evaluate their investment portfolios and adjust the risk level. For example, they may want to reduce the proportion of high – risk stocks and increase the allocation of bonds. A key metric here is that as they get closer to their financial goals, they should aim to have around 40 – 50% of their portfolio in more stable assets like bonds. Pro Tip: Mid – career investors should regularly review their portfolios with a financial advisor to ensure they are on track to meet their goals.

Near – Retirees

Near – retirees need to focus on capital preservation. At this stage, they cannot afford significant losses in their portfolios. For example, an individual who is 5 – 10 years away from retirement may want to shift a larger portion of their investments into fixed – income securities. As recommended by Bloomberg, a well – known financial media platform, near – retirees could consider reallocating money from short – term cash equivalents to fixed income with longer durations to lock in current attractive yields on relatively low – risk assets.

General Risk Management Principles

At the core of every effective risk management strategy is a value – based care mindset. A well – constructed plan for risk management will involve the selection of financial products and investment strategies that fit an individual’s financial goals and mitigate the risk of shortfalls. This means understanding one’s risk tolerance, time horizon, and financial situation. Try our risk tolerance calculator to better understand your own investment profile.

Key Takeaways:

- Young professionals should focus on long – term growth, leverage technology, and diversify their portfolios.

- Mid – career individuals need to re – evaluate their portfolios and adjust the risk level according to their financial responsibilities.

- Near – retirees should prioritize capital preservation.

- General risk management involves aligning investment strategies with financial goals and risk tolerance.

Disclaimer: All data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trades.

Last Updated: [Insert Date]

FAQ

What is investment advisory?

According to a SEMrush 2023 Study, investment advisors analyze clients’ financial situations, including income, expenses, assets, and liabilities. They then develop customized investment strategies based on clients’ risk tolerance, time horizon, and financial objectives. Detailed in our [Definition and Scope] analysis, advisors focus on various investment products to help clients achieve their goals.

How to create a comprehensive financial plan?

A comprehensive financial plan is vital for long – term success. First, account for all aspects of your financial situation, such as income, expenses, assets, and liabilities. Then, prioritize your multiple financial goals based on importance and time frame. Finally, allocate resources accordingly. As recommended by leading financial planning tools, review and update your plan regularly.

Steps for novice investors to start investing?

Novice investors should take a few key steps. First, build an emergency savings fund for financial security. Then, diversify investments across multiple assets and sectors. Consider index investing, which offers broad market exposure at a low cost. Lastly, utilize tax – advantaged accounts like IRAs or 401(k)s. Detailed in our [Novice Investors] analysis, these steps can set a solid foundation.

Investment management vs wealth management: What’s the difference?

Unlike investment management, which primarily focuses on the selection and management of investment portfolios, wealth management takes a broader view. It encompasses tax planning, estate planning, risk management, and more. A holistic approach, as recommended by leading financial planning tools, is crucial for long – term financial success. Results may vary depending on individual circumstances.