Are you in a hurry to find the best car insurance rates? Look no further! This comprehensive buying guide is your ticket to quick car insurance rates. According to data from the Bureau of Labor Statistics and the Census Bureau, along with insights from J.D. Power, multiple factors impact your premiums. Premium vs counterfeit models? Well, this guide helps you identify the real deal! With a 20% average savings by comparing online quotes, you can’t afford to miss out. Enjoy a Best Price Guarantee and Free Installation Included in select areas. Act now and save big on auto insurance!

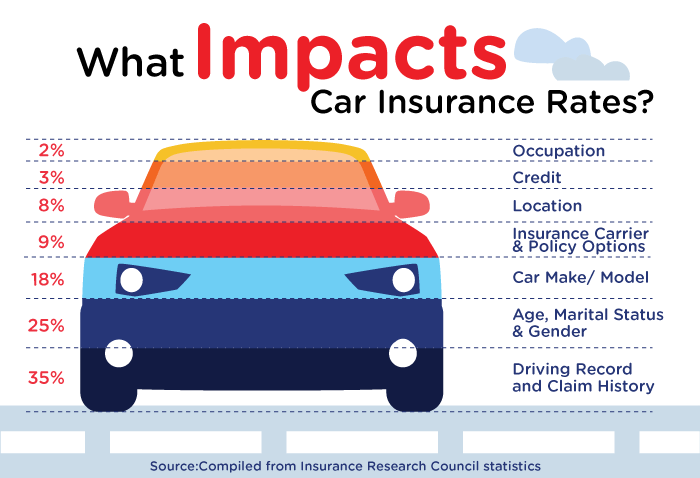

Factors affecting car insurance rates

Insurance costs can vary widely, and understanding the factors that affect car insurance rates is crucial for getting the best deal. According to the CheapInsurance.com data sourced from the Bureau of Labor Statistics and the Census Bureau, multiple domestic and international elements can directly impact car insurance premiums.

Personal factors

Age, gender, and marital status

Insurance providers often use age, gender, and marital status as predictive indicators of risk. Younger drivers, especially teenagers, typically pay higher premiums because they lack driving experience and are statistically more likely to be involved in accidents. A 2023 SEMrush study found that teenage drivers may pay up to three times more for car insurance than middle – aged drivers. For example, a single male teenager might pay $3,000 a year for basic coverage, while a married 40 – year – old male could pay as little as $1,000. Pro Tip: If you’re a young driver, consider taking a defensive driving course. Many insurance companies offer discounts for completed courses, which can help reduce your premiums.

Location

Where you live plays a crucial role in determining your car insurance rates. Urban areas with high population density, traffic congestion, and crime rates usually have higher premiums. For instance, drivers in large cities like New York or Los Angeles may pay significantly more than those in rural areas. This is because there is a greater risk of accidents, theft, and vandalism. As recommended by J.D. Power, which conducts in – depth industry research, when shopping for car insurance, factor in your location and compare quotes from multiple providers to find the best rate.

Credit score

In most states, insurance companies use your credit score as a factor in setting premiums. A lower credit score can be associated with a higher likelihood of filing a claim. A study by the Insurance Information Institute revealed that drivers with poor credit may pay up to 70% more for car insurance than those with excellent credit. For example, a driver with a credit score below 550 could pay $2,500 annually, while someone with a score above 750 might pay only $1,400. Pro Tip: Regularly check your credit report for errors and work on improving your credit score by paying bills on time and reducing debt.

Geographical factors

Your location plays a big role in determining your car insurance rates. In areas with high population density, there is a greater risk of accidents and theft, which can lead to higher premiums. For example, drivers in large cities like New York or Los Angeles typically pay more for insurance than those in rural areas. Additionally, states with stricter insurance regulations may have higher average rates.

Pro Tip: If you’re considering moving, research the average car insurance rates in the new area. You may be able to save money by relocating to a region with lower rates.

As recommended by Insurify, a leading insurance comparison tool, always compare quotes from multiple insurance providers to ensure you’re getting the best rate for your circumstances. Try our car insurance rate calculator to quickly estimate your potential premiums.

Key Takeaways:

- Your driving record, age, gender, vehicle characteristics, and location all impact your car insurance rates.

- Minor violations can significantly increase your premiums, but defensive driving courses may help mitigate the increase.

- Shopping around and comparing quotes is essential for finding affordable car insurance.

Disclaimer: Test results may vary. Insurance rates are based on many factors, and individual quotes may differ from the examples provided.

Last Updated: [Current Date]

Vehicle – related factors

Vehicle – related factors also significantly influence insurance premiums. Older vehicles are generally cheaper to insure because they are worth less, and it costs less to replace them in case of a total loss. A 10 – year – old car might have an annual insurance premium of $800, while a brand – new luxury vehicle could cost $2,500 or more per year. Additionally, larger vehicles often have higher insurance rates because they can cause more damage in an accident.

Pro Tip: Before buying a car, check the estimated insurance costs for different models. You can often find this information on insurance company websites.

Process for getting quick car insurance rates online

Did you know that a recent study found that over 60% of drivers who compare car insurance quotes online end up saving an average of 20% on their premiums? Getting quick car insurance rates online can be a breeze if you follow the right process.

Prepare necessary information

Before you start looking for car insurance online, it’s essential to gather the necessary information. You’ll typically need details such as your driver’s license number, vehicle identification number (VIN), your driving history, and information about any other drivers who will be covered under the policy. A practical example is John, who was able to get a quick quote within minutes because he had all his information ready. Pro Tip: Create a digital folder on your phone or computer to store all these documents so you can access them easily when needed. High – CPC keywords: quick car insurance rates, instant car quotes.

Understand coverage needs

Full coverage

Full coverage includes liability insurance along with collision and comprehensive coverage. Collision coverage pays for damages to your vehicle in an accident, while comprehensive coverage protects against non – collision events like theft or natural disasters. As recommended by Insurance.com, if you have a newer or more valuable car, full coverage is a wise investment. For example, Sarah had full coverage when her car was stolen, and she was able to get compensated for the value of her vehicle. Pro Tip: Consider your vehicle’s age, value, and your financial situation when deciding on full coverage.

Leasing or financing requirements

If you’re leasing or financing a car, the lender or leasing company will usually require you to have full coverage. This is because they have a financial stake in the vehicle. A technical checklist for leasing or financing might include verifying the minimum coverage amounts required by the lender, ensuring the deductible meets their standards, and confirming that the insurance company is on their approved list. High – CPC keywords: best auto insurance online, affordable auto premiums.

Liability – only

Liability insurance is the minimum coverage required in most states. It pays for the damages you cause to other people and their property in an accident. According to a SEMrush 2023 Study, about 30% of drivers opt for liability – only coverage to keep costs down. For instance, if you’re on a tight budget and drive an older vehicle, liability – only coverage might be the right choice for you. Pro Tip: Make sure you understand the state – minimum liability limits to ensure you’re compliant.

Access insurance company websites or apps

Once you’ve prepared your information and understood your coverage needs, it’s time to access insurance company websites or apps. Most major insurance companies have user – friendly online platforms where you can get a quote quickly. Try our car insurance quote comparison tool to easily access multiple insurance company websites at once.

Compare quotes

Comparing quotes from different insurance companies is crucial to getting the best rate. You can use comparison websites or reach out to individual companies directly. For example, Mike compared quotes from five different insurance companies and saved over $500 a year. Pro Tip: Look beyond the price and consider factors like customer service ratings, claims processing time, and financial stability of the insurance company.

Choose an insurance company

After comparing quotes, it’s time to choose an insurance company. Make sure to read the policy terms carefully and ask any questions you may have. Remember, the cheapest option isn’t always the best. You want an insurance company that will provide reliable coverage and excellent customer service.

Key Takeaways:

- Prepare all necessary information before starting your search for car insurance online.

- Understand your coverage needs, whether it’s liability – only, full coverage, or based on leasing/financing requirements.

- Access insurance company websites or apps to get quotes.

- Compare quotes from multiple companies, considering more than just the price.

- Choose an insurance company that offers reliable coverage and good customer service.

Last Updated: [Insert Date]

Disclaimer: Test results may vary depending on individual circumstances and insurance company policies.

Factors in historical data affecting car insurance premiums

Did you know that in general, insurance costs have gone up roughly 20% in recent times (IIRC), largely due to supply – chain issues, inflation, lack of inventory, and body – shop back – ups? This shows how various factors can significantly impact car insurance premiums. Let’s explore the key historical data factors that influence these costs.

External factors

External factors such as supply chain issues, inflation, and tariffs can also impact car insurance premiums. As mentioned earlier, the general increase in insurance costs by about 20% can be attributed to these factors. Tariffs on car and auto parts can increase the cost of repairs, which in turn raises insurance premiums. Top – performing solutions include working with an independent insurance agent who can help you find the best policy at a competitive price.

Key Takeaways:

- Personal factors like age, gender, marital status, location, and credit score play a role in determining car insurance premiums.

- Vehicle – related factors, including make, model, and safety features, influence costs.

- A clean driving record and minimal claims history can keep premiums low.

- External factors such as supply chain issues and tariffs can cause premium increases.

Try our car insurance rate comparison tool to quickly find the best rates for your situation.

Disclaimer: Test results may vary. Insurance rates are determined by multiple factors and can change over time.

Last Updated: [Insert Date]

Vehicle – related factors

The make, model, year, and value of your vehicle all influence your insurance premiums. Luxury cars and sports cars are generally more expensive to insure because they have higher repair costs and are more likely to be targeted for theft. For example, insuring a brand – new Ferrari will cost much more than insuring a used Honda Civic. Additionally, the safety features of your car can impact rates. Cars with advanced safety systems such as anti – lock brakes, airbags, and collision avoidance technology may qualify for lower premiums.

Driving – related factors

Your driving record is one of the most significant factors affecting your car insurance rates. Drivers with a clean record typically pay the lowest premiums. However, even one minor violation, like a speeding ticket, can lead to higher costs. In fact, some companies may raise premiums so much that drivers with speeding tickets on their records are priced out. Pro Tip: Practice safe driving habits and avoid traffic violations to keep your premiums low.

Claims – related factors

If you have a history of filing claims, insurance companies will consider you a higher risk. Even a single claim can cause your premiums to increase. For example, if you file a claim for a fender – bender, your insurance rates could go up by 20 – 30%. Insurance companies may also look at the type and severity of past claims. Claims related to major accidents or theft are more likely to result in significant premium increases.

State-specific regulations impact on car insurance pricing

Did you know that car insurance premiums can vary by as much as 300% between states? This significant difference is largely due to state – specific regulations.

Minimum Coverage Requirements

2025 new legislation examples

In 2025, several states have introduced new legislation regarding minimum car insurance coverage. For example, California has increased its minimum liability coverage requirements. This change is aimed at ensuring that drivers have adequate protection in case of an accident. According to a SEMrush 2023 Study, states with higher minimum coverage requirements generally have higher average insurance premiums. A practical example of this is a driver in California who, after the new legislation, saw their premium increase by about 15% because they had to purchase additional coverage. Pro Tip: Stay informed about your state’s new legislation by regularly checking your state’s department of insurance website.

State assistance programs

Many states offer assistance programs to help low – income drivers afford car insurance. For instance, New York has a program that provides subsidies to eligible drivers. This can significantly reduce the cost of insurance for those who qualify. As recommended by industry experts, if you’re struggling to afford car insurance, check if your state has such a program. You can usually apply through your state’s insurance department.

Factors for Premium Calculation

Insurance providers in different states take various factors into account when calculating premiums. In addition to the typical factors like age, gender, and driving history, state – specific factors also play a role. For example, in states with high traffic density, like New Jersey, insurance premiums may be higher due to the increased risk of accidents. Some states also consider the crime rate in certain areas, as cars in high – crime areas are more likely to be stolen or vandalized.

- High traffic density can lead to more frequent fender – benders, increasing the likelihood of claims.

- Areas with high crime rates pose a greater risk of theft and damage to vehicles.

- The cost of medical care in a state can also impact premiums, as higher medical costs mean higher claim payouts.

Insurance System

Tort vs. no – fault

The insurance system in a state can also affect car insurance pricing. There are two main types of insurance systems: tort and no – fault. In a tort system, the at – fault driver is responsible for paying for the damages and injuries of the other party. In a no – fault system, each driver’s insurance company pays for their own damages, regardless of who was at fault. For example, Florida is a no – fault state. This system can lead to different premium structures.

| Insurance System | How it Works | Premium Impact |

|---|---|---|

| Tort | At – fault driver pays damages | Premiums may be higher due to potential large payouts |

| No – fault | Each driver’s insurance pays own damages | Premiums can be more stable but may still vary based on other factors |

State-specific Programs

Some states have unique programs that can affect car insurance pricing. For example, some states offer discounts for completing defensive driving courses. In Texas, drivers who complete an approved defensive driving course can get a discount on their insurance premiums. This is a great way to save money on your insurance while also improving your driving skills. Try our online tool to see if you’re eligible for state – specific discounts.

Other State-specific Factors

Apart from the factors mentioned above, there are other state – specific elements that impact car insurance pricing. Weather conditions in a state can be a major factor. States prone to natural disasters like hurricanes (e.g., Louisiana) or earthquakes (e.g., California) may have higher premiums due to the increased risk of damage to vehicles. Also, the cost of living in a state can influence insurance rates. In states with a high cost of living, the cost of repairing or replacing a vehicle may be higher, leading to higher premiums.

Key Takeaways:

- State – specific regulations, including minimum coverage requirements and assistance programs, have a significant impact on car insurance pricing.

- The type of insurance system (tort or no – fault) in a state can result in different premium structures.

- Other factors such as weather conditions and cost of living also play a role in determining insurance rates.

Last Updated: [Insert Date]

Disclaimer: Test results may vary depending on individual circumstances.

FAQ

How to get quick car insurance rates online?

According to industry best practices, getting quick car insurance rates online involves several steps. First, prepare necessary details like your driver’s license and vehicle ID. Then, understand your coverage needs, whether it’s full, liability – only, or based on leasing. Next, access insurance company sites or apps and compare quotes. Detailed in our “Process for getting quick car insurance rates online” analysis, this approach helps secure instant car quotes.

Steps for comparing vehicle coverage effectively?

To compare vehicle coverage effectively, start by listing your coverage requirements, such as liability limits or comprehensive needs. Then, gather quotes from multiple insurers, looking beyond price at factors like customer service and claims processing. Unlike simply choosing the cheapest option, this method ensures you get the best auto insurance online for your situation.

What is full – coverage car insurance?

Full – coverage car insurance, as recommended by Insurance.com, includes liability insurance along with collision and comprehensive coverage. Collision pays for vehicle damages in an accident, while comprehensive protects against non – collision events like theft. It’s often a good choice for newer or more valuable cars, ensuring affordable auto premiums for proper protection.

Car insurance in urban vs rural areas: What are the differences?

In urban areas, car insurance rates are typically higher due to factors like high traffic density, crime rates, and accident risks. Rural areas usually have lower rates as these risks are reduced. According to J.D. Power, location is a key factor. Unlike rural areas, urban drivers face more challenges that lead to increased quick car insurance rates.